What is a

Nursing Home Trust?

Nursing Home Trusts is the comprehensive term we use to describe the guidance and financial products that our organization has used for 30 years to protect over 500,000 families’ life savings from exorbitant nursing home costs. Nursing Home Trusts demystifies the financial side of the nursing home industry by empowering you with the strategies and tools to secure your family’s financial legacy. We believe everyone has the right to quality care without declaring bankruptcy. We’ve helped hundreds of families enjoy the golden years without financial anxiety — and we can do the same for you.

“We would have lost everything in under 9 months. Instead, we protected $83,000 of Mom’s life savings. Now, my brother’s and I each have Nursing Home Trusts for $12,500, and Mom only pays a social-security check co-pay for her care.”

-Linda S.

MORE THAN

500,000

families have turned to us to preserve their assets for their loved ones. They took their financial futures back into their own hands.

WE CURRENTLY SERVE

48 States

across the U.S., including Alaska and Hawaii. In 2020 alone, we served clients in 37 different states.

IN 2020 ALONE WE PROTECTED

$121M

in assets for our clients and their families so that they could get back to focusing on their loved ones’ care.

The most efficient “money-defense” strategy, carefully engineered to work for you.

/01

The Nuts & Bolts

The two primary techniques most families can benefit from are specialized irrevocable life insurance trusts and single premium immediate annuities (sometimes called Medicaid annuities).

Both of these products are designed specifically with nursing home asset protection in mind. When set up correctly, they are not considered an asset by the nursing home or Medicaid, nor do they count against you during the dreaded 5-Year Lookback period.

/02

The look-back period can be a tricky subject, and it’s the reason nursing home residents can’t just start giving away money to friends and family without careful planning. When you apply for Medicaid, the five years leading up to your application date will be reviewed for gifting, selling, or transferring assets that could have been used to pay for their long-term care… but that’s not the whole story.

Nursing Home Trusts are exempt from the 5 year look-back period. We’ll work with you to ensure that your assets are tucked away in the appropriate places so that you’ll be free from penalty or ineligibility. We’re happy to help you navigate the system, with no obligations, gotcha moments, or hidden fees! Our financial and legal strategies are 100% free.

/03

We’re no spring chicken. In fact, we’ve spent over 30 years protecting seniors and their families from aggressive facilities and sky-high medical costs. We pull the right documentation from our extensive library of archives in order to serve your specific needs. These documents can include irrevocable trust documents, specialized insurance contracts, funeral and burial space goods and services, medicaid annuity paperwork and more.

/04

We know you’re busy. We team up with other trusted professionals from insurance carriers, trust companies, technology companies and law firms in order to do the hard work for you ahead of time. Our knowledge on the subject of trusts and asset protection along with the expertise of our partners plays an integral role in serving you.

There’s no need to even leave your living room to get the guidance you deserve. Our services are all offered at no cost to you either online or via the phone. Just the click of a button right here on our website can help you get started toward the ultimate financial protection from nursing home costs. In some locations, in-person meetings are available.

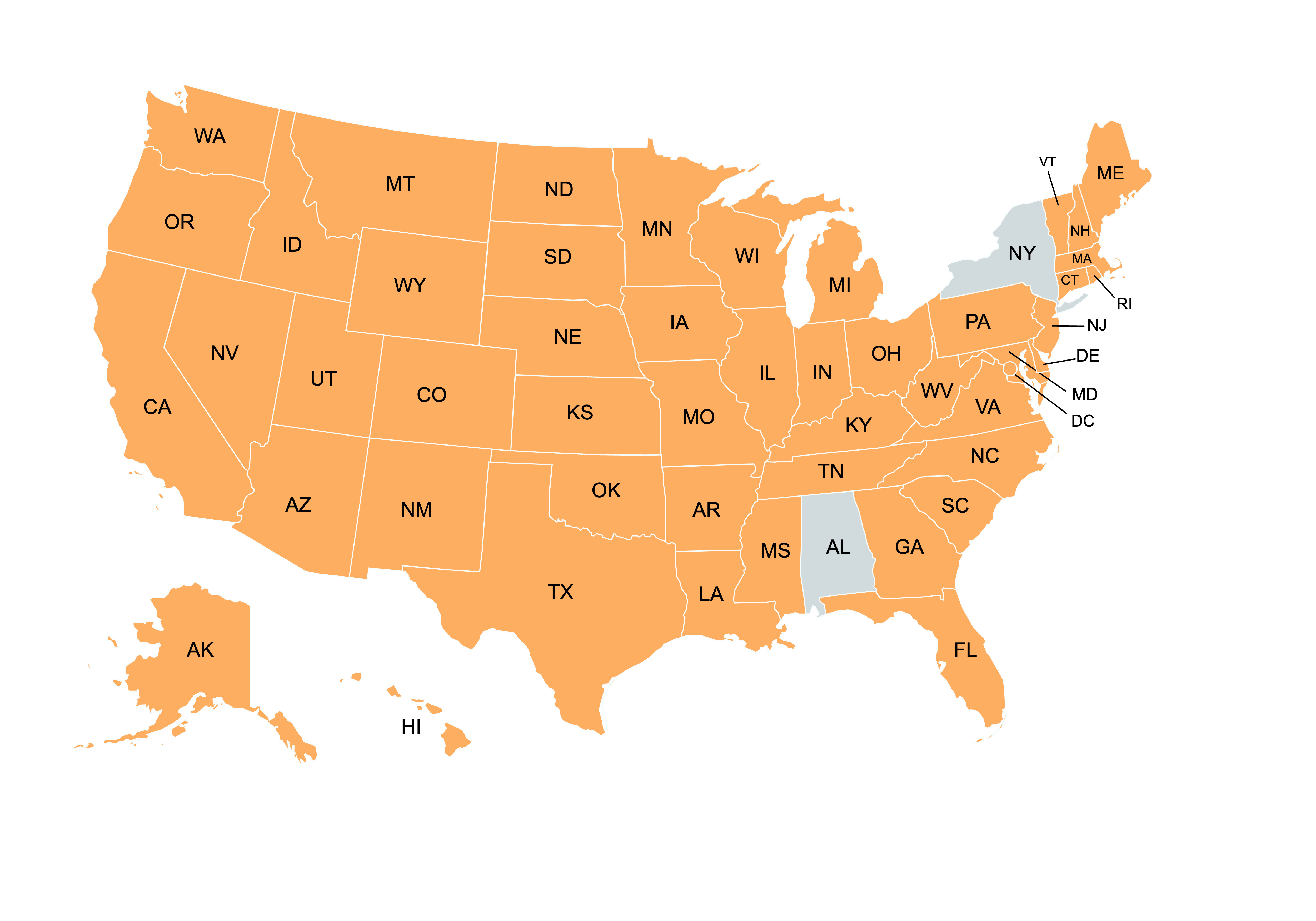

AREAS WE SERVE

We serve 48 states

across our country.

Our goal is to protect families in the entire Union. We are currently serving 48 of the United States, including Alaska and Hawaii.

Starting your protection plan with us is no cost to you. We’ll guide you through all the state laws and eligibility requirements and equip you with the materials needed to make the best decision for your family, based on your state’s own laws and eligibility requirements. Unlike nursing homes, we won’t force you to do anything.

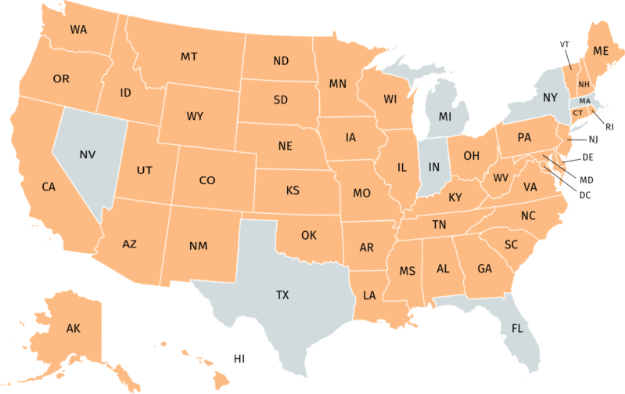

AREAS WE SERVE

We serve 43 states across our country.

Our goal is to protect families in the entire Union. We are currently serving 43 of the United States, including Alaska and Hawaii.

Starting your protection plan with us is no cost to you. We’ll guide you through all the state laws and eligibility requirements and equip you with the materials needed to make the best decision for your family, based on your state’s own laws and eligibility requirements. Unlike nursing homes and law firms, we won’t force you to do anything.

Nursing homes provide the nursing care you need.

We provide the financial care your life savings deserve.

Click the button below to discover how much money you can protect from the nursing home in less than 5 minutes with our specialized tool.