We’re here to guide you through every step of the process

We know time is of the essence in a nursing home situation. $300/day, $9,000 a month, $108,000 a year. We realize you need to act fast before everything is gone.

Here’s the good news: we move at your pace. If you’re able and ready to provide all the necessary information we need to establish Nursing Home Trusts for your family, most cases can be completed within 5-10 business days. Modern technology allows us to complete all consultations via the web and phone, and signing of documents can be done electronically via Docusign.

Every family is unique. In most cases families can protect between 50% and 95% of their life savings. Use our free diagnostic tool to get an estimate of how much your family can protect in 5 minutes or less. Alternatively call 1-855-248-1759 or email info@nursinghometrusts.org to consult with a licensed expert today.

Yes! You’re exactly the person our company is built to help. Too many believe that it’s impossible to protect life savings after you’ve entered a skilled nursing facility. Even more believe that nothing can be done during a “Medicaid spend-down” or “5 year look-back”. When set up properly, all of our strategies work within the 5 year look-back while your loved one is in a nursing home, and none of the protected assets count against you for Medicaid application.

Unfortunately, no. Once the nursing home takes your money, it’s gone forever. We often describe this situation as “use it or lose it”, and it always pains us to speak with families who waited too long or didn’t have a chance to look for solutions. We realize there’s very little information to help families like you, and we only wish we had found each other earlier.

While most of our products and services are designed to be used while in a Medicaid spend-down situation, we are happy to speak with you now. Oftentimes, the peace of mind we provide families who are struggling to understand their situation is of even greater value than the protection of their life savings. If you’re looking for an expert to examine your situation and explain it in layman’s terms, we are here to help. Call us at 1-855-277-7342 or email us at info@nursinghometrusts.org to get started.

One of our licensed experts will work with either the spouse of the individual in the nursing home or their power of attorney. We encourage you to involve as many family members or advocates as you desire in our initial consultations; however, a POA or a spouse is required to put your asset protection plan into place.

We are not a non-profit organization, but we really don’t charge families a single penny for our services. When we establish Nursing Home Trusts for your family, the A.M. Best rated “Excellent” trust companies compensate us directly. The trust companies are able to invest the money that you would have otherwise lost, and they share some of this revenue with our organization. Fortunately, this means you are able to protect your loved ones’ assets without paying a penny out-of-pocket. 100% free, no hidden fees or gimmicks.

Other families with higher net worth may additionally benefit from “medicaid annuities”. These financial instruments are more complicated and usually require outside expertise from one of our strategic partners – normally a NAELA accredited elder law attorney.

We never hold any of our clients’ money. Your savings go directly from your bank accounts into insurance policies which are then placed inside irrevocable (permanent) trusts. Once inside the trusts, these funds are untouchable by 3rd parties like nursing homes, creditors or lawyers. All of our insurance carrier and trust partners are “A” rated by A.M. Best.

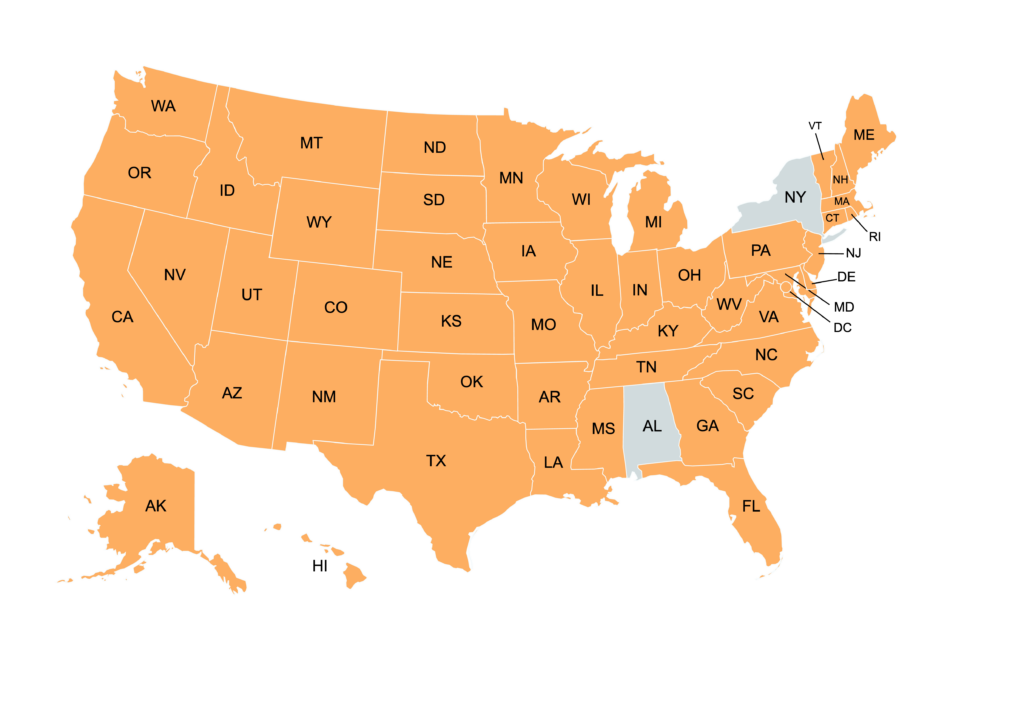

Here’s a map of states we are currently licensed to operate within:

Visit our free diagnostic tool here to get an estimate on how much of your family’s assets we can protect in 5 minutes or less. You can also call us at 1-855-248-1759 to speak with a licensed representative from 9-5 EST. Alternatively, email us at info@nursinghometrusts.org and we’ll get back to you ASAP.

Give us a call, our team of experts is standing by to help

Email us your questions or comments

(513) 572-5723

Give us a call, our team of experts is standing by to help

info@nursinghometrusts.org

Email us your questions or comments

Nursing homes provide the nursing care you need.

We provide the financial care

your life savings deserve.

Click the button below to discover how much money you can protect from the nursing home in less than 5 minutes with our specialized tool.

(513) 572-5723

info@nursinghometrusts.org

© Copyright Nursing Home Trust. All rights reserved

Privacy Policy | Terms of Use